Treasurer

svasek@euclidschools.org

Phone: (216) 797-2915

Fax: (216) 289-8845

Parents

Students

District

Community & Alumni

The Euclid Schools are committed to fiscal responsibility. The office of the Treasurer oversees all financial operations of the Euclid City School District. The Treasurer also serves as Public Records Officer and reports directly to the Board of Education.

Major functions of the Treasurer's Office include Annual Budget Reporting, Financial Forecasting, Grants Management, Payroll, Accounts Payable, Accounts Receivable, Budgets/Appropriations, Fixed Asset Inventory, Investments, Employee Benefits, Public Records, and Student Activities.

How are our schools funded?

School funding is comprised of two primary sources in Ohio: Local school district property tax collections and State of Ohio Foundation Funding payments.

Local Support

Local funding is primarily from property tax levies voted and approved by the District's taxpayers. When a district needs additional operating funds, it puts an operating levy on the ballot for voters to approve.

When levies are approved, the amount of money stays about the same for the life of the levy. The District has two types of operating levies: "Continuing levies" which do not expire and "Emergency levies" which collect a fixed amount of tax revenue over a set amount of time, usually 5 to 10 years.

Continuing operating levies collect about the same amount of tax revenues annually for the life of the levy, except for increases due to new construction. This is because of House Bill (HB) 920, a law passed in 1976. So in periods of inflation, HB 920 effectively freezes the amount of taxes collected in the first year the millage went into effect. The law requires the County auditor to adjust the voted millage annually, so as property values increase, the voted millage decreases to ensure no additional tax revenue is collected on outside millage. This is called the “effective millage.” Inside millage is not affected by HB 920, so a small amount of additional revenue is generated by property valuation increases.

State Support

The second type of funding comes from the State of Ohio. The State determines the level of funding each school district receives through its biennium budget. The current foundation formula model is comprised of a multi-tiered model designed to determine the minimum amount necessary to fund a fair and appropriate education.

Treasurer

svasek@euclidschools.org

Phone: (216) 797-2915

Fax: (216) 289-8845

Reporting Fraud

TIps or complaints of fraud may be reported to the Ohio Auditor of State at any time by any public employee or private citizen. Please access the Ohio Auditor of State's fraud reporting tools at: https://ohioauditor.gov/fraud/

Public Records Request

All requests for records shall be submitted to the District's Custodian of Records Stephen A. Vasek. Requests can be made through telephone call, by mail, email or in person during normal business hours.

Click here to access Euclid Schools Checkbook

Appropriations

2023-2024 Appropriations

Annual Financial Reports

2022 Fiscal Year Annual Financial Report

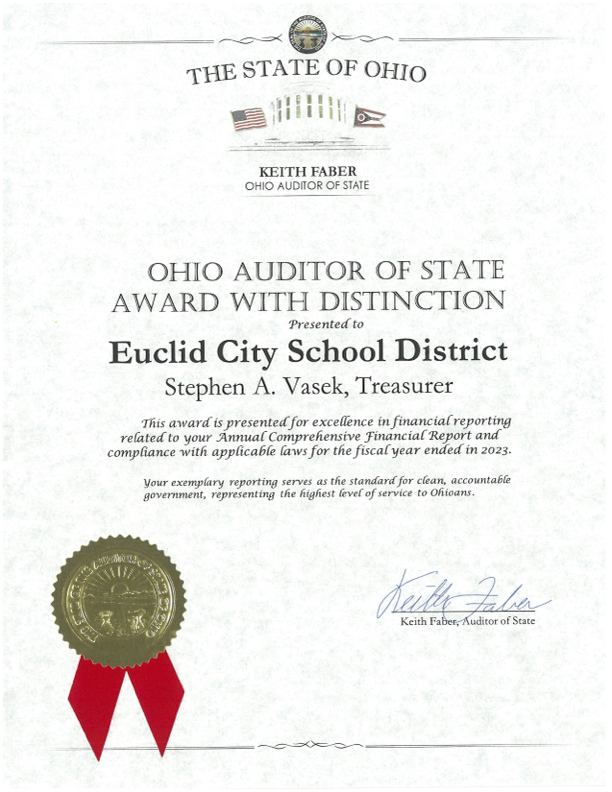

Audit Review

Ohio Auditor Search

Click the link above to review the Euclid Schools financial audits.

Five Year Forecast

Click the link above to see Our Euclid Schools five year forecast.

Requests for Proposals